SOL Price Prediction: Path to $300 Amid Technical Consolidation and Institutional Support

#SOL

- Technical Breakout Potential: SOL must clear the $257 resistance level to initiate momentum toward $300

- Institutional Support vs. Market Headwinds: Strong treasury purchases contrast with FTX-related sell pressure

- Ecosystem Growth Indicators: Cross-chain expansions and adoption metrics will be crucial for sustained price appreciation

SOL Price Prediction

SOL Technical Analysis: Key Levels to Watch

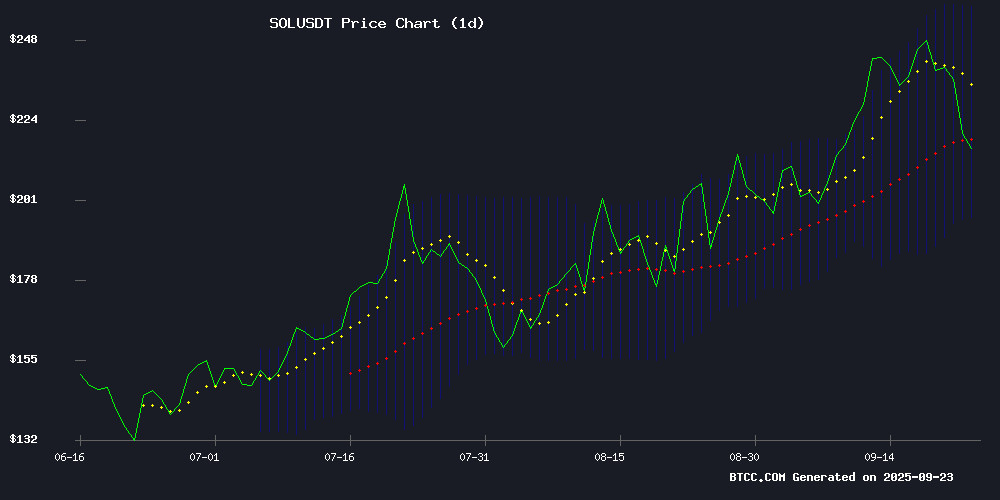

SOL is currently trading at $218.97, below its 20-day moving average of $226.89, indicating short-term bearish pressure. The MACD shows a slight bullish divergence with the histogram at 0.3993, though both MACD lines remain in negative territory. Bollinger Bands suggest SOL is trading NEAR the middle band, with resistance at $257.19 and support at $196.59.

According to BTCC financial analyst Olivia, 'The technical setup shows SOL is testing critical support levels. A break above the 20-day MA could signal renewed bullish momentum toward the $240 resistance zone.'

Mixed Sentiment Surrounds SOL Despite Institutional Interest

Recent developments present a complex picture for Solana. While institutional investments totaling over $1.4 billion and treasury purchases by companies like Helius Medical Technologies provide strong fundamental support, the 7% price drop and leadership changes at SOL Strategies create near-term uncertainty.

BTCC financial analyst Olivia notes, 'The institutional backing is impressive, but market sentiment is being tempered by the FTX payout concerns and recent security incidents. The $240 level remains a critical psychological barrier.'

Factors Influencing SOL's Price

Solana (SOL) Price Drops 7% Despite $1.4 Billion in Institutional Investments

Solana's native token SOL fell 7.11% to $215.46, testing key support levels despite significant institutional inflows. The decline appears to be technical profit-taking rather than a reflection of weakening fundamentals.

Pantera Capital's $1.1 billion commitment to Solana on September 16 stands as one of the largest institutional bets on the ecosystem. Galaxy Digital followed with a $300 million acquisition of SOL from Binance and Coinbase, signaling expectations of future supply constraints.

The RSI reading of 45.89 suggests neutral momentum, with potential for an oversold bounce. Market participants appear to be balancing short-term profit-taking against long-term institutional conviction in Solana's blockchain infrastructure.

Leah Wald Steps Down as CEO of SOL Strategies Amid Solana-Focused Transition

Leah Wald, the architect of SOL Strategies' transformation from Cypherpunk Holdings into a Solana-centric investment firm, will depart as CEO effective October 1. Her exit follows a landmark year featuring a Nasdaq listing and a complete strategic pivot toward staking and infrastructure within the Solana ecosystem.

Michael Hubbard, Chief Strategy Officer and board member, assumes interim leadership while the firm searches for a permanent successor. Wald's tenure saw the firm abandon its legacy Bitcoin-heavy portfolio, rebrand under the SOL banner, and develop proprietary treasury management protocols for Solana-based assets.

Solana Retests Critical Support After Sharp $240 Pullback

Solana's price action has reached a decisive inflection point following a 10.8% retreat from its $240 peak. The cryptocurrency now hovers near $214, testing a converted resistance-turned-support level that previously marked its breakout zone.

Market observers note the correction liquidated overleveraged positions, with SOL's failure to reclaim short-term moving averages suggesting continued bearish pressure. The diagonal support, now serving as a bull-bear battleground, must hold to prevent a deeper retracement toward $200.

Trading charts reveal momentum has decidedly shifted, with the breakdown indicating more than routine profit-taking. While some frame the move as healthy consolidation, SOL's inability to regain higher ground keeps traders wary. The coming sessions will prove critical in determining whether this represents a reset for continuation or the start of more significant downside.

Helius Medical Technologies Makes $167M Solana Treasury Purchase Backed by Pantera Capital

Helius Medical Technologies has positioned itself among the largest corporate holders of Solana after acquiring 760,190 SOL tokens worth $167 million. The neurotech company executed the purchase at an average price of $231 per token, deploying capital from its recent $500 million funding round led by Pantera Capital and Summer Capital.

The move signals a strategic treasury shift toward digital assets, with Helius retaining over $335 million in cash reserves for potential additional SOL acquisitions. "This accumulation plan demonstrates our focus on maximizing shareholder value through disciplined capital allocation," said Pantera's Cosmo Jiang, who advises the company as board observer.

Market observers note the purchase reflects growing institutional confidence in Solana's ecosystem, particularly among healthcare and technology firms diversifying treasury strategies. The transaction ranks among the most significant corporate crypto allocations since MicroStrategy's bitcoin acquisitions.

Streamer Loses $31K in Solana to Malware Attack While Raising Funds for Cancer Treatment

Latvian livestreamer Raivo "Rastaland" Plavnieks suffered a devastating setback in his crypto fundraising campaign after falling victim to a malware attack. The streamer, who created the Solana-based token Help Me Beat Cancer (CANCER) on Pump.fun to finance treatment for his rare sarcoma, lost $31,189 when a viewer-suggested Steam game contained wallet-draining malware.

The incident occurred during a Sunday stream when Plavnieks downloaded Block Blasters, a seemingly legitimate game on the Steam platform. Upon launching the game, malicious code siphoned the Solana (SOL) he had raised through creator fees from his token sales. The attack was captured live on stream, with Plavnieks' distraught reaction underscoring the personal stakes of the theft.

In a display of crypto community solidarity, supporters quickly mobilized to offset the losses. Traders pumped the CANCER token, donors sent replacement funds, and some community members began tracking the attackers. The response highlights both the vulnerabilities and the communal strength of web3 ecosystems.

Will FTX Payouts Trigger Altcoin Market Sell-Off?

FTX’s bankruptcy estate prepares to distribute $1.6 billion in its third wave of repayments starting September 30, bringing total recoveries above $8 billion. The collapse of the exchange nearly three years ago left clients with an $8 billion shortfall. While this marks progress in resolving Sam Bankman-Fried’s fallout, creditors remain divided on whether the restitution is adequate—some argue it fails to account for opportunity costs.

Payouts vary significantly by jurisdiction: U.S. customers will recover 95% of claims, international users on FTX’s "dotcom" platform 78%, and certain government claims up to 120%. Distributions will flow through partners like Kraken, BitGo, and Payoneer within three business days. Market participants are closely watching whether these disbursements could pressure altcoins, particularly SOL, which remains a focal point in FTX’s asset portfolio.

South Korea Set for First Public Solana Treasury Acquisition Backed by Fragmetric & DFDV

Fragmetric Labs and Nasdaq-listed DeFi Development Corp (DFDV) are collaborating to establish South Korea's first Solana-based digital asset treasury. The partners plan to acquire a publicly listed Korean company as the vehicle for this initiative, marking a strategic integration of blockchain technology into traditional finance.

The project aims to create new investment opportunities while bolstering Solana's institutional adoption. Fragmetric emphasized this move will embed SOL's high-performance blockchain infrastructure into national financial strategies, positioning South Korea as a crypto innovation hub.

DFDV's involvement signals broader ambitions beyond treasury creation, with plans to expand its DeFi ecosystem exposure. The Nasdaq-listed firm's participation lends institutional credibility to Solana's growing role in regulated financial markets.

PancakeSwap Expands Cross-Chain Swaps to Solana Amid Market Volatility

PancakeSwap has integrated Solana into its cross-chain swap feature, enabling users to exchange tokens across multiple blockchains seamlessly. The update eliminates the need for bridging assets or switching platforms, leveraging PancakeSwap's liquidity pools for instant settlements.

Solana's inclusion allows swaps between SOL and EVM-compatible chains like BNB Chain, Ethereum, and Arbitrum via Relay, a multichain payment network. Despite the technical milestone, SOL remains 7.19% below pre-crash levels, reflecting broader market pressures.

Will SOL Price Hit 300?

Based on current technical and fundamental analysis, reaching $300 represents a significant 37% upside from current levels. The path appears challenging but possible with favorable conditions.

| Factor | Bullish Case | Bearish Case |

|---|---|---|

| Technical Levels | Break above $257 resistance could target $300 | Failure at $196 support may lead to $180 |

| Institutional Flow | $1.4B+ investments provide solid foundation | FTX sell-off risk creates overhead pressure |

| Market Sentiment | Growing ecosystem adoption (PancakeSwap expansion) | Recent security concerns dampen retail interest |

BTCC financial analyst Olivia suggests, 'While $300 is achievable in the medium term, SOL needs to consolidate above $240 first. The institutional backing is strong, but technical resistance and market sentiment need to align.'